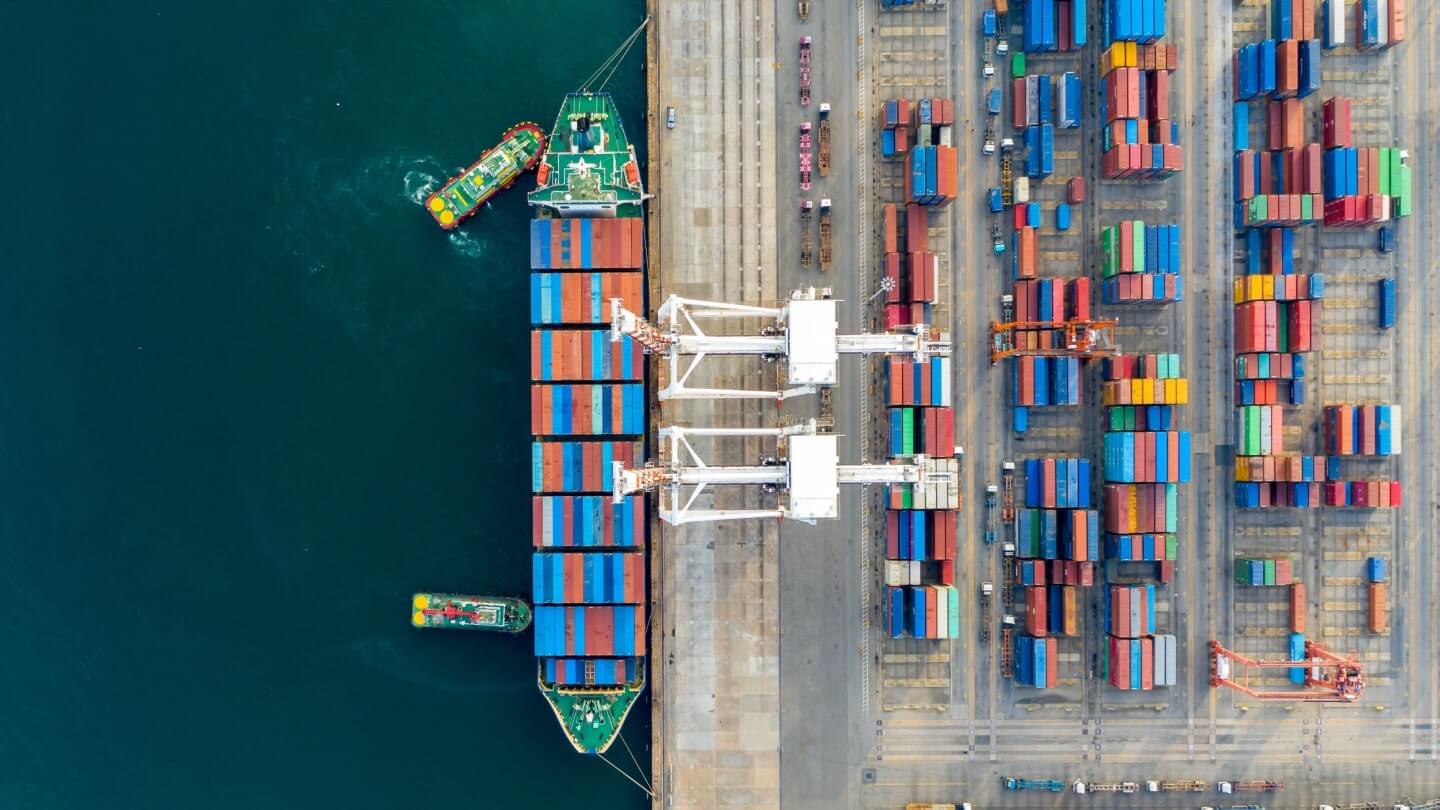

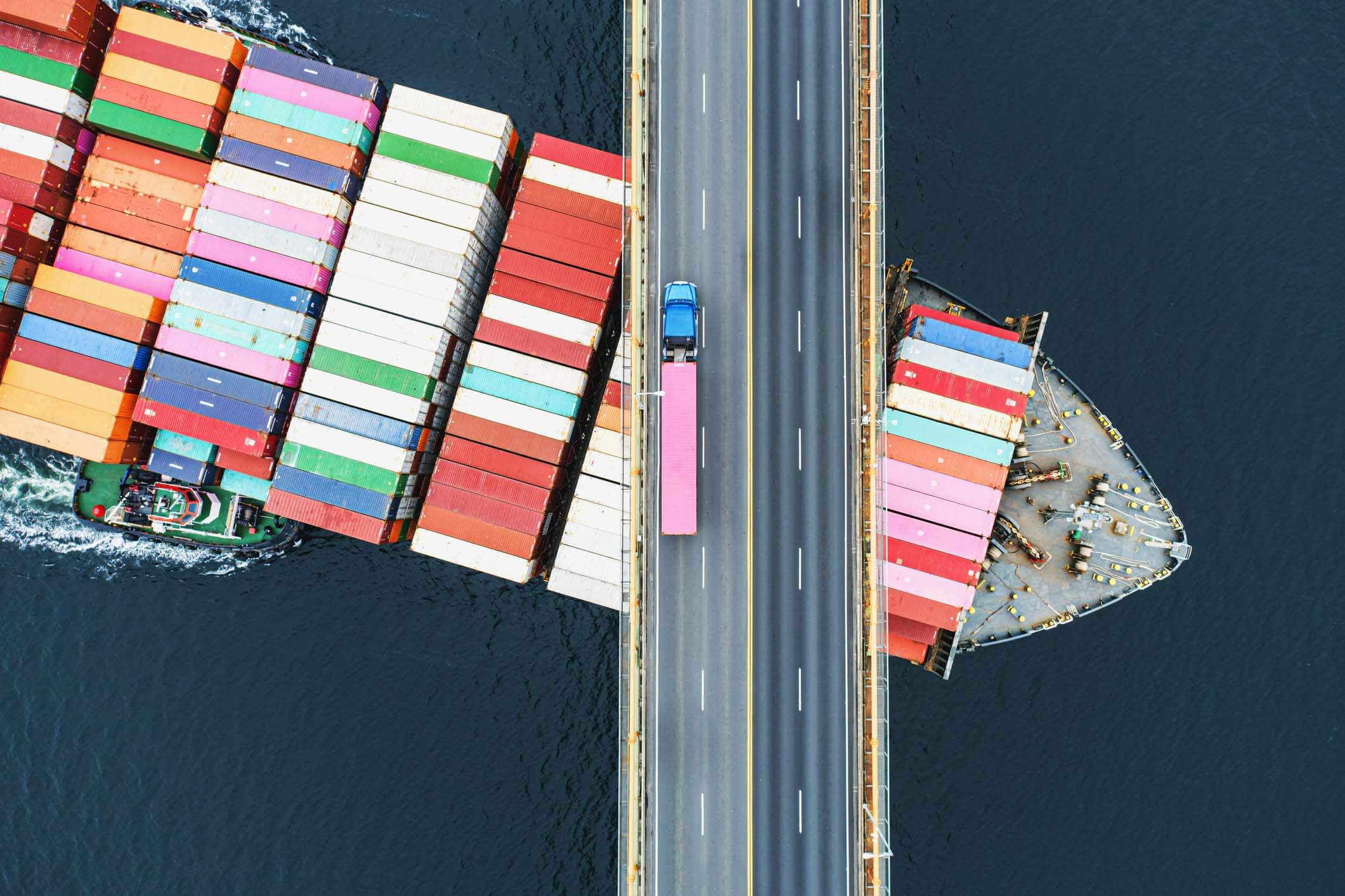

In global shipping transactions, choosing the right Incoterm is crucial for clarifying each party’s responsibilities. CFR (Cost and Freight) is a popular term that splits costs and risks between buyers and sellers in a structured way. With CFR, the seller covers shipping to the buyer’s port, while the buyer takes on risk once the goods are on board. This article explains CFR’s key aspects, responsibilities, and how it compares to other Incoterms, giving buyers and sellers a clear understanding of its advantages in international trade.

What is CFR?

CFR (Cost and Freight) is an Incoterm that stipulates that the seller is responsible for delivering goods to the buyer’s designated port. However, while the seller pays for the freight and transportation costs to this port, risk transfer occurs at the port of shipment. This means that after the goods are loaded onto the vessel, any risks, such as damage or loss, are transferred to the buyer.

In essence, CFR allows the buyer to handle insurance and other responsibilities for the goods from the moment they are shipped. This arrangement provides a balance of control, with sellers handling upfront transportation costs and buyers overseeing risks from the port of departure.

Key Responsibilities Under CFR

Under CFR terms, the division of responsibilities between the seller and buyer ensures each party manages specific stages of the shipping process.

Seller’s Responsibilities:

- Arrange and pay for the transport of goods to the port of destination.

- Handle export documentation, licenses, and customs clearance in the country of origin.

- Load goods onto the vessel.

- Provide the buyer with necessary documents, such as the bill of lading and invoice.

Buyer’s Responsibilities:

- Assume risk for goods from the moment they are loaded onto the vessel.

- Arrange and pay for insurance if desired, as CFR does not require the seller to insure goods.

- Handle customs clearance, import duties, and taxes at the port of destination.

- Manage the unloading and subsequent transport of goods from the port of destination to the final location.

When is CFR Commonly Used?

CFR is most often used for sea and inland waterway transport, making it ideal for bulk and heavy shipments. It’s beneficial in scenarios where the seller has easier access to local transportation services and can manage shipment up to the port more efficiently than the buyer.

For instance, sellers often use CFR when they have established relationships with local shipping companies, giving them more negotiating power over transportation costs. On the other hand, buyers can benefit from CFR by only taking on the cost and risk once the goods are at sea, potentially saving on unnecessary expenses and resources.

CFR vs. CIF: Key Differences

CFR is similar to another popular Incoterm, CIF (Cost, Insurance, and Freight). However, CIF includes one additional component: insurance. Under CIF terms, the seller must arrange and pay for insurance coverage up to the port of destination, providing the buyer with additional protection.

For this reason, buyers seeking added security often opt for CIF instead of CFR. However, CFR can be more cost-effective when buyers already have insurance options or prefer to manage insurance on their own.

Advantages of Using CFR in Shipping

For Sellers:

- Control Over Shipping Process: Sellers can negotiate favorable freight rates and ensure timely delivery to the port.

- Simplified Documentation: The seller is responsible for arranging export clearance, which can streamline the process in the country of origin.

For Buyers:

- Cost Management: Buyers only cover insurance costs if they wish, avoiding unnecessary expenses.

- Risk Management Flexibility: Buyers have control over risk from the port of loading, giving them more oversight for high-value or sensitive goods.

Potential Disadvantages of CFR

Under CFR terms, buyers face several key considerations. First, they are exposed to risk from the moment the goods are loaded onto the vessel, as any damage or loss during transit is their responsibility from the port onward. Additionally, buyers must manage import documentation and customs requirements at the destination port, which can add layers of complexity, especially when navigating unfamiliar regulations. Lastly, because CFR does not include insurance, buyers must bear the cost and responsibility of arranging insurance for the goods from the point of loading if they wish to have coverage during transit.

How to Decide When to Use CFR

When deciding to use CFR, both buyers and sellers should evaluate the trade-offs in terms of cost, risk management, and control over the shipping process. CFR works well when:

- The buyer has a good logistics team or insurance provider to manage risk from the port of loading.

- The seller has access to reliable shipping providers for seamless delivery up to the port.

On the other hand, buyers with less experience in handling risk or complex logistics may prefer CIF to reduce potential liabilities.

Conclusion

CFR (Cost and Freight) is a practical Incoterm in international shipping, providing a clear division of cost and risk between buyers and sellers. By understanding the key aspects of CFR, companies can make informed decisions that align with their logistics capabilities and risk tolerance. Whether you’re a buyer looking to control risk or a seller wanting to manage shipping up to a specific port, CFR is a flexible, efficient solution in the world of global trade.